Royal Directives to Cessate Withholding Tax on Dividends and Income from Bonds and Sukuk for Foreign Investors Affirms Commitment to Oman 2040

HE Sheikh Abdullah al Salmi, Executive President of the Capital Market Authority (CMA), stressed that the Royal Directive to cessate the application of withholding tax on stock dividends and income of fixed instruments (sukuk and bonds) owned by foreign investors is an affirmation of the attention and care that His Majesty Sultan Haitham bin Tariq - may God protect and preserve him - and his government attach to the need to provide all factors that will enhance the investment environment in the Sultanate of Oman and make Muscat Stock Exchange (MSX) an attractive investment destination for foreign capital. This in turn will boost trading in the MSX, enhance its capitalization value, and boost the role of the capital market as a tool for financing economic projects as part of the efforts to achieve Oman’s vision 2040.

In a statement to local media, HE Al Salmi expressed the importance of these Royal Orders that stipulate the suspension of the withholding tax permanently with immediate effect, where appropriate legislative amendments are to be effected in due course. Such amendments shall ensure the exclusion dividends and income from bonds and sukuk from the scope of this tax. This would enhance the confidence of foreign investors in the investment climate in the country, and reassure them that this tax will not be applied to their investments in the capital market in the Sultanate of Oman.

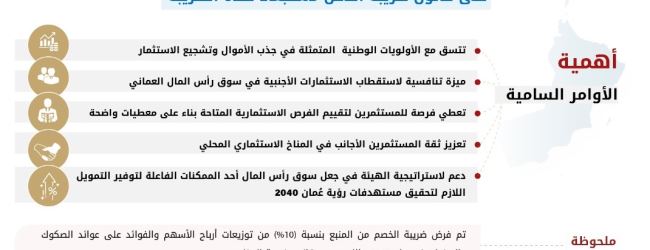

The Executive President of the CMA pointed out that Royal Directive to permanently abolish this tax on foreign investors are consistent with the national priorities directing the executive plans of government agencies, which focus on attracting capital and encouraging investment. They also give the capital market in the Sultanate of Oman a competitive advantage to attract direct and indirect foreign investments to the Sultanate of Oman. This is of strategic importance in light of the intense competition in the region and the world to attract capital, and give investors the opportunity to evaluate available investment opportunities based on clear data and objective criteria. It will also answer a lot of questions or concerns that have been pondered upon by investors about the fate of this tax. At the same time, it will support the CMA’s executive strategy to make the capital market a key and effective enabler for providing the necessary financing to achieve the objectives of Oman’s Vision 2040.

It is worth noting that the Sultanate of Oman imposed a (10%) withholding tax on dividends and income from sukuk and bonds in 2017, as part of the Income Tax Law amendments. Although the aforementioned tax was suspended for a period of three years, starting from 6/5/2019, which was later extended to 2025 as part of the economic stimulus plan approved by the Council of Ministers, its existence in the law was a source of concern for several investors .

Therefore, the Royal Orders to abolish this tax on foreign investors once and for all, in light of the intense competition that the region is witnessing in attracting capital, presents a golden opportunity to attract more foreign investments to the Sultanate of Oman .